In today’s volatile and highly interconnected business environment, financial risk is no longer a peripheral concern, it has become a strategic priority for every organization. Global economic uncertainties, fluctuating markets, regulatory shifts, and disruptive technologies are redefining how businesses operate. Organizations that fail to integrate financial risk management into their strategic planning often find themselves exposed to:

-

Cash flow disruptions that threaten operational stability,

-

Eroding profitability caused by unmanaged exposures, and

-

Limited resilience when facing crises or unexpected downturns.

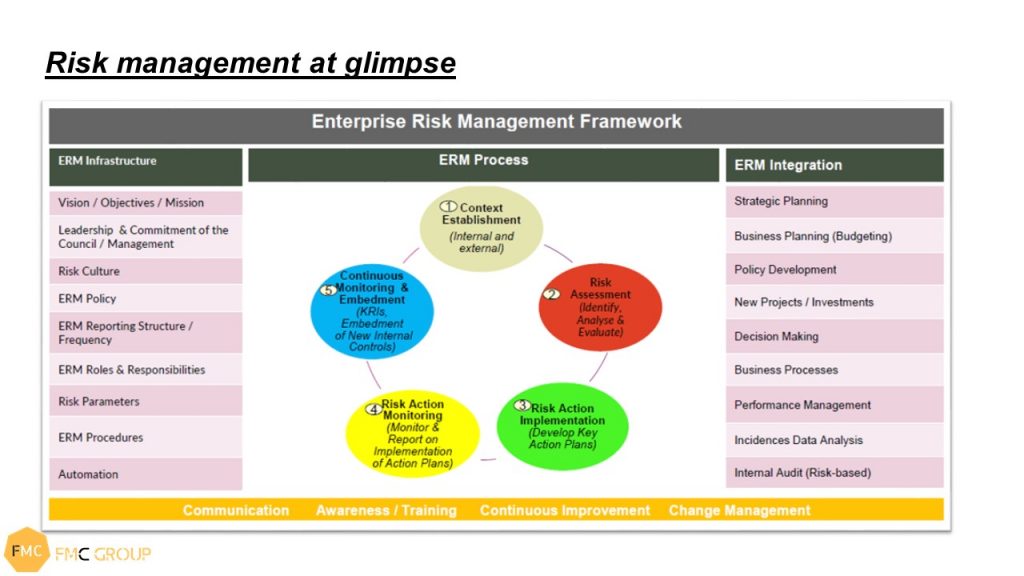

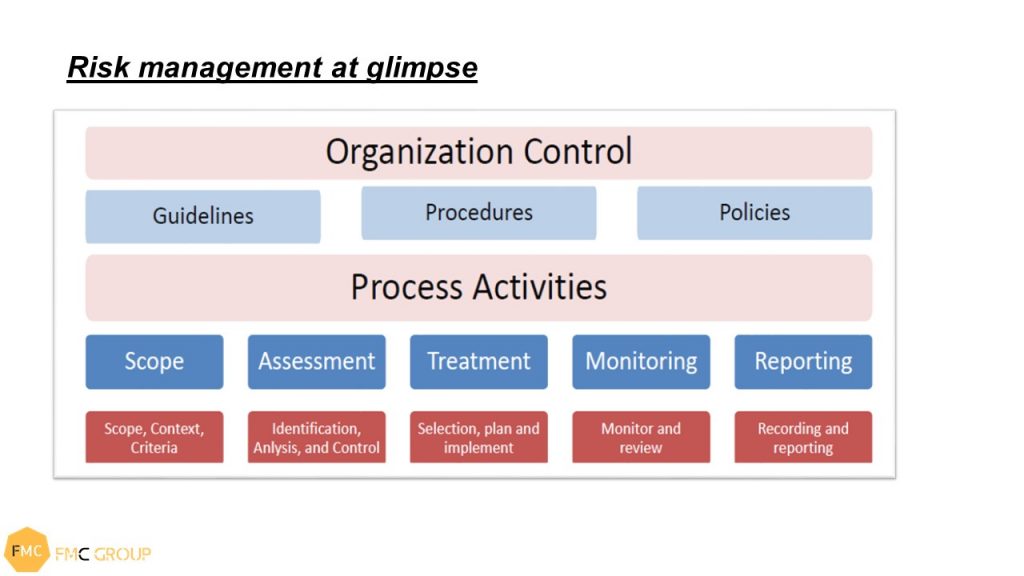

A robust financial risk management framework is no longer optional, it is essential. By identifying, assessing, and managing financial risks proactively, organizations can protect shareholder value, optimize resource allocation, and strengthen their competitive advantage.

More importantly, effective financial risk integration enables leaders to make informed, data-driven strategic decisions, ensuring that business objectives are aligned with the organization’s risk appetite. This approach transforms risk management from a reactive process into a proactive strategic tool, empowering companies to navigate uncertainty, capture new opportunities, and achieve sustainable long-term growth.

The Strategic Importance of Integrating Financial Risk into Planning

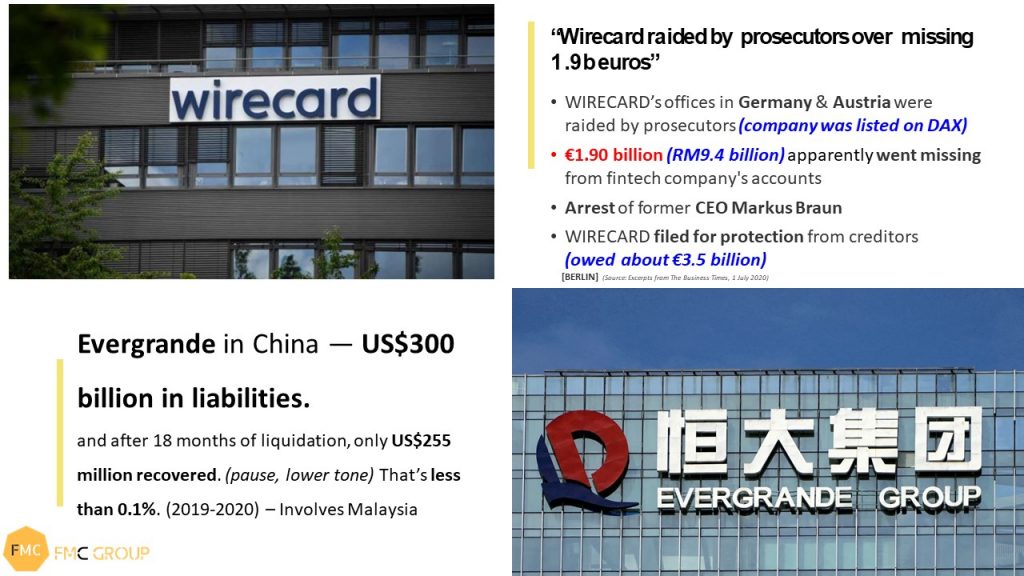

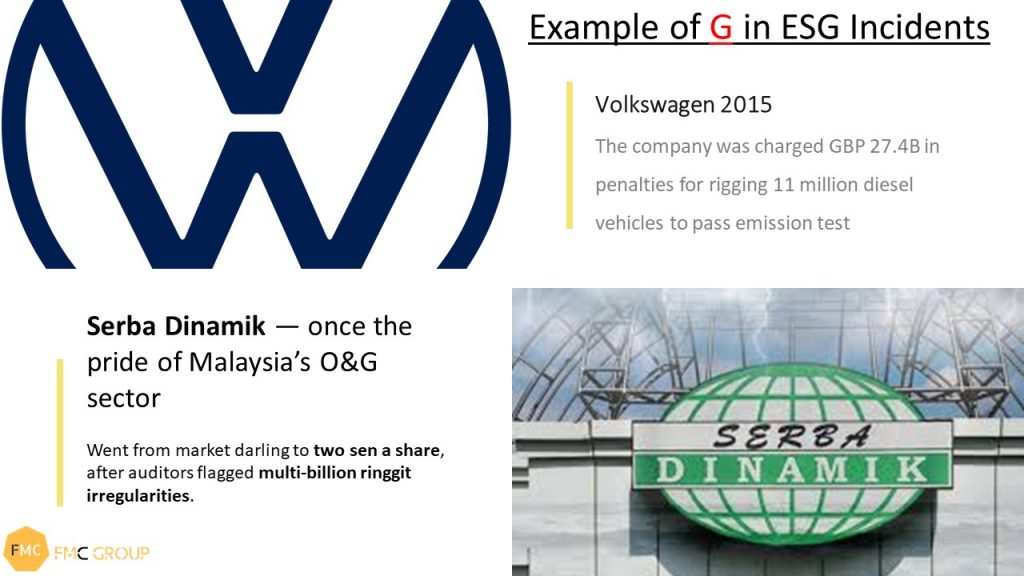

Strategic plans are traditionally designed to drive growth, capture new markets, and foster innovation. However, in today’s increasingly complex business landscape, financial risks have become a critical factor that can make or break even the most carefully crafted strategies.

Fluctuating interest rates, volatile foreign exchange movements, tightening liquidity conditions, rising credit exposures, and evolving regulatory frameworks can all disrupt business performance and erode shareholder value if not properly managed. What may look like a sound growth strategy on paper can quickly unravel when unexpected financial shocks occur.

To overcome these challenges, financial risk assessments must be embedded directly into the strategic planning process, not treated as a separate exercise. This integration ensures that decisions are anchored in financial realities, enabling leaders to anticipate potential pitfalls and respond proactively.

When organizations integrate financial risk into their strategy, they gain significant advantages:

-

Stronger, Data-Driven Decision-Making

Leaders can make informed strategic choices based on comprehensive risk insights rather than assumptions, resulting in more predictable business outcomes. -

Optimized Capital Allocation

Resources are directed toward initiatives that balance growth opportunities with the organization’s risk appetite, ensuring that investments are both profitable and sustainable. -

Enhanced Investor and Stakeholder Confidence

Transparent and structured financial risk integration strengthens trust among shareholders, regulators, and partners by demonstrating robust governance and resilience. -

Increased Organizational Resilience

By anticipating potential disruptions and preparing contingency strategies, businesses are better equipped to navigate volatility and adapt quickly to changing market conditions.

In essence, strategic planning without financial risk integration is incomplete. Organizations that view financial risk management as a core driver, not just a safeguard, but are better positioned to innovate confidently, expand sustainably, and build long-term value.

The Strategic Advantage

Companies that integrate financial risk management into their strategic plans are better positioned to capitalize on opportunities while mitigating downside exposures. This integration transforms financial risk from a compliance exercise into a competitive advantage, enabling organizations to:

- Drive sustainable growth

- Protect profitability

- Strengthen long-term stakeholder trust

Conclusion

Financial risk management is no longer optional, it is a strategic imperative. Organizations that successfully integrate financial risk considerations into their strategic planning frameworks are better equipped to navigate uncertainty, outperform competitors, and deliver lasting value.

At Faisal Malik & Co., we help organizations embed financial risk intelligence into their strategies, ensuring resilience, agility, and sustainable success. Reach our team at admin@faisalmalikco.com

Written by Mohamad Faisal, and these are his personal views.

Mohamad Faisal C.A.(M), CIPFA, CPSA, ASEAN CPA, CFP, DPIN has extensive experience in finance, corporate affairs, and SME development. He is a certified business mentor, chartered accountant, financial planner, and qualified business coach. He received exposure through the “Business Mentoring for Mentors” program from the Entrepreneurship Development Institute of India (EDII) and completed “Entrepreneurship in Emerging Economies” from HarvardX Business School.

He currently serves as a council member of two national professional bodies, Chairman of SMP Malaysia, Accounting Industry Member of MPC, industry advisor to three local universities, and is also the founder of FaisalMALIK & Co [CA].

For consultancy and advisory services, contact the FMC team at admin@faisalmalikco.com

Disclaimer

All content provided on this ‘www.faisalmalikco.com’ for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site.

The owner of www.faisalmalikco.com will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

This terms and conditions is subject to change at anytime with or without notice.

![Faisal Malik & Co [FMC Group]](https://faisalmalikco.com/wp-content/uploads/2018/03/logo.png)